The growth and success of most businesses often requires access to additional funds. If your small business is in need of extra money, secured loans can be the key to overcoming challenges or taking advantage of available opportunities.

Secured loans are typically offered by financial institutions to business owners who require capital to start a new business, expand an existing one or pay for business-related expenses.

This loan requires upfront collateral which reduces risk for the lender, allowing them provide a lower interest rate that can be paid back more easily by the borrower.

In simpler terms, you are assuring the lender of paying back the amount you borrow. And if you are unable to repay the sum, the lender is free to utilize the pledged asset or personal guarantee to recover their losses. Secured business loans offer affordable interest rates and longer term duration.

When Should I Take Unsecured Business Loans ?

A secured business loan is an excellent solution for those with a poor credit rating. It is a great option if you want to start a new business or expand your business. If your secured business loan is approved, you will have a lower APR rate and very likely a longer repayment period. This can make it affordable for start-up businesses to get the cash they need during a time when profits are just starting to grow.

Unsecured loans appear more attractive, but although they are often approved quickly, there is a bigger cost involved. Unsecured mean that there is no collateral offered, thus making it a risky business for the lender. Therefore, banks are obliged to charge higher interest rates, and some of them get the most out of it by charging exorbitant interest to reduce the risk on their capital.

| Business Loan Interest Rate | Competitive interest rate starting at 12.15% or Plus |

| Loan Amount | Minimum 3 Lakhs Maximum 1 Crore |

| Nature of Business Loan | Unsecured (No mortgage required) |

| Loan Tenure | Ranges from 24 months to 60 months |

| Processing Fee | Up to 2% of loan amount |

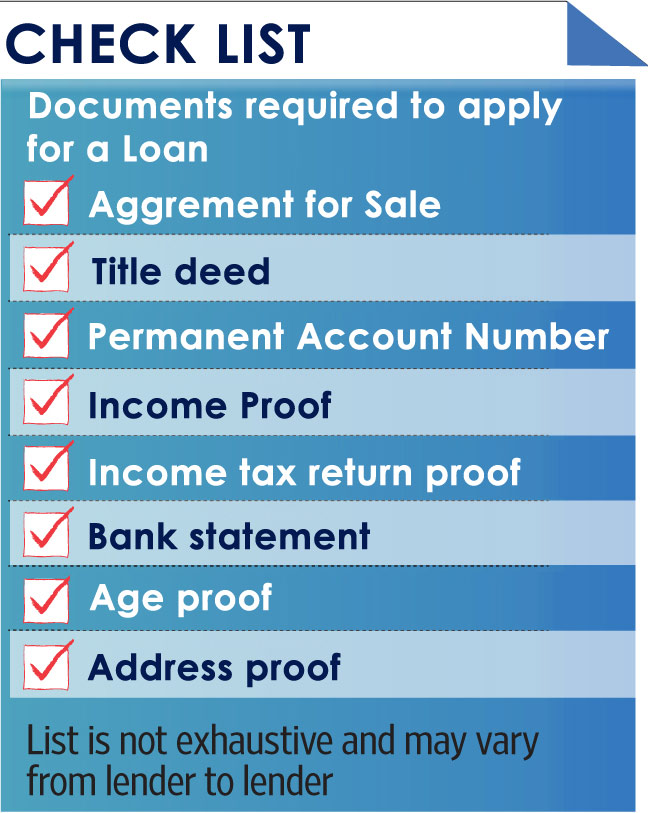

Documents Required

Every customer has to satisfy the Know Your Customer (KYC) norms stipulated by RBI. You have to provide the documents relating to your KYC, employment, business, and income.

Identity Proof

- PAN Card

- Aadhar Card

- Voter ID

- Driving Licence

- Passport

Address Proof

- Registered Rent agreement

- Aadhar Card

- Driving License

- Lease agreement

- Passport

- Latest Gas or electricity bill

Financial Documents – Employment or Business Proof

- Salary slips for the last 6 months in case you are a salaried employee (In addition, you can provide IT returns for the past 3 years along with Form 16)

- IT returns for the past 3 years in case you are self-employed (Some banks accept 2 years IT returns as well)

- Statement of A/c for the past 1 year where your salary is credited (in case of salaried people)

- Profit and Loss statement and Balance sheet for the last 2 years in case of self-employed persons

- Sales tax, GST registration certificates, if applicable

- Partnership deed in case of partnership firms (if the applicant is one of the partners)

- Certificate of Incorporation in case of limited companies(if the applicant is one of the directors)

Other documents:

- Loan application form duly filled in

- Photographs

- Signature Proof

There is nothing like a free lunch in this world. Therefore, you should be ready to pay the processing fees for your housing loan. Is this the only charge you will incur? It depends from bank to bank. Some banks charge less processing fees, but may make up for that somewhere else. On the other hand, some banks and financial institutions consolidate their charges and include them in the processing fees. Let us look at some common charges you will most likely incur when you apply for a Loan Against Property.

- Upfront fee for processing –Many banks charge an upfront fee for processing your application. This is usually in the range of 3000 to 5000. This is a non-refundable fee, even in case the bank rejects your loan application. In case they sanction your loan, they adjust this fee in their regular processing fees.

- Processing fee –This amount ranges from 0.25% to a maximum of 2% depending on your employment status. Salaried employees incur a smaller fee whereas self-employed professionals and business persons have to pay more. Some banks do have a uniform rate. Note that you have to pay GST @ 18% on this processing fee.

- Valuation charges –Many banks charge for the valuation of the property. They have independent evaluators on their panel. These banks have a fixed structure of payment. Some banks insist that the customer pays to the bank whereas some of them include this amount in their processing fee structure.

- Legal scrutiny charges –Legal scrutiny of the property is mandatory. The financing bank has to ensure that you get a clear title to the property so that the mortgage holds well in law. Therefore, they have a panel of legal experts who carry out the search for a period of 30 years. You need to supply the property documents to these advocates to allow them to do the needful. Some banks ask the customer to pay the advocates separately whereas many banks include these charges in their processing fees.

Qualifying for a business loan from BANK is simple. You just need to fulfill the following criteria to avail the benefits of the loan:

-

You should be between 25-55 years old.

-

Your business should have a vintage of at least 3 years.

-

Your business should have its Income Tax returns filed for at least the past 1 year.

You may need to submit other relevant financial documents at the time of document verification. You will be informed of these as and when required.

Here is a list of the Business Loan customer profiles that we consider:

- Self Employed Professionals (SEP)

- Allopathic doctors, chartered accountants, company secretaries and architects who are practicing their profession. Proof of qualification – document to be shared

- Self Employed Non Professionals (SENP)

- Traders and manufacturers, retailers, Proprietors, and service providers etc

- Entities

- Partnerships, Limited Liability Partnership, Private Limited and closely held Limited companies. Other constitution types depending on their profile on a case to case basis

- On completion of this process, you will be able to choose the offer that suits your requirements. You should keep your documents and the application forms ready. Uplaxya Consultants Pvt. Ltd. has a special team to assist you in this regard at no extra cost.

- The lender has the responsibility of verifying the KYC and income proof documents. The lender would like to inspect the property and have a discussion with the borrower to obtain first-hand information about the borrower’s employment, business, income, and investments.

- Verify the creditworthiness of the owner(s) of the business.

- Verify the business related documents such as physical verification of the office, analysis of the business bank statements and audited account reports and the previous two ITR filings of the business.

- Based on the past records verify the creditworthiness and the repayment capability of the business.

- Inform the applicants of their final eligibility, and the attached interest rates, tenures and other important terms and conditions and additional fee and charges.

- Should the applicant agree, finish the loan processing and approve the loan amount and the disbursal method.

- Loan disbursal.

Secured Business: Secured business loans are different from unsecured business loans because you need to offer some type of collateral to the lender in case you default on your payments for the loan. Basically, collateral is something that you can pledge as a security for repayment of a loan. Some examples of collateral include a home, a car, investments, or other assets that can be liquidated.

Because the loan is “secured”, interest rates are usually lower on secured business loans. They are also easier to get because they pose a smaller risk for the bank.

Unsecured Business Loans: Unsecured loans are given without any kind of collateral from the buyer. They are made on the basis of your credit rating and other methods to determine your creditworthiness. Because these risks are unsecured and there is no collateral, there is a greater risk for the lender. Because of this, they usually have higher interest rates than secured loans and they are also harder to obtain than secured loans. Keep in mind that sometimes the interest rates on unsecured business loans can be higher than the interest rates on your credit card. Usually, the interest rate for this type of loan is fixed but it is possible to have an unsecured loan with a variable interest rate. Regardless, the unsecured business loan will always be higher than the secured business loan.

Frequently asked questions (FAQ)

Your eligibility is determined after looking at the following: Last 2-3 years business financials Years in business and current level of business activity Nature of the industry the business operates in and how that industry has fared in recent times The current level of obligations of the borrower i.e. the other installments (EMIs), credit limits and other types of finance the business entity may have The borrowers credit history

Different financial organizations have different time periods allotted to the various kinds of loans that they offer. Most organizations that offer unsecured business loans, claim to disburse the small business financing option of a business loan in roughly five to seven working days. This comparatively faster access to funds is helping close the lending gap that SMEs in India mostly go through. SME Corner – an online lender of unsecured business loans offers loans within three business days, if all the paperwork and necessary processes are in place.

Advantages Of A Secured Business Loan Lower Interest Rates – Secured business loans typically have low interest rates than other financing products, such as unsecured loans, credit cards, or lines of credit. This is because having secured collateral reduces the lender’s potential risk. Longer Repayment Terms – Secured loans can have longer repayment terms, sometimes as long as 10 to 30 years. Your lender will provide set terms based on your business needs and situation. If your business would benefit from extended payment terms, a secured business loan would be an advantage. Note that the longer the payment terms of the loan, the higher will be the total financial cost of the additional capital. Easier to Qualify – If your business is established and profitable, normally more than two years under the same management, it’s easier to obtain a since it is less risky for the lender since it has claim on the secured asset. Higher Capital Amounts – Secured business loans come in larger amounts because of the lower risk for the lender. As with any financial loan, the amount that you borrow should be what you need, not what you want. You will need to balance the loan amount with the collateral asset you need to pledge to the lender. For example, if your collateral asset is your business building, you should have a market appraisal value to determine if the loan amount requested is in proportion. If not, consider some other business asset to pledge as collateral for the loan.

Pledge Of Collateral Asset – You must pledge a business asset that is acceptable to the lender to secure the loan. Normally this is a physical asset, such as a building, equipment or vehicles. Some lenders also consider for certificates of deposit of long duration as a means to reduce risk. Without an acceptable business asset, your business will not qualify for this financing option. Risk Of Default and Loss Of Asset – If your business is unable to repay the loan (default), the lender can and likely will take possession of the collateral asset. Also, the value of the collateral asset lost may be greater than the actual value of the secured business loan (e.g., building or real-estate). Your business may not survive the loss of the pledged asset if it critical to its operations. Start Ups Need Not Apply – Lenders requirements of loan recipients normally require that a business have as least two years under the same ownership and be profitable to qualify for a secured business loan. While the lender will take into consideration the credit and financials of the business, it is the type and value of the collateral asset pledged that will be the major consideration. If your business is new or doesn’t have strong financials, getting approval of a secured loan will be difficult.

Each financial organization, big or small alike will have their own set of documents that will need to be uploaded or submitted during the application stage of a loan. While some organizations require you to submit an extensive list of documents, some have a short list that enlists all the necessary paperwork. SME Corner requires applicants to submit minimal paperwork. Providing the supporting financial documents that we require, helps us evaluate your creditworthiness better and faster, but in case the client is unable to provide soft copies, we facilitate the collection of the required documents, in person.

Secured business loans are a common funding instrument for small businesses. A secured business loan is any type of business funding instrument secured by a personal guarantee or by pledging valuable assets as collateral.

In simpler terms, you are assuring the lender of paying back the amount you borrow. And if you are unable to repay the sum, the lender is free to utilize the pledged asset or personal guarantee to recover their losses. Secured business loans offer affordable interest rates and longer term duration.

All types of small businesses could benefit greatly from this type of loan, however, companies that have mutual funds, vehicles, inventory, equipment, accounts receivable, land, buildings or other property to put up as collateral will have significantly lower payments and significantly longer repayment periods as compared to unsecured, collateral-free loans

Qualifying for a business loan from BANK is simple. You just need to fulfill the following criteria to avail the benefits of the loan:

-

You should be between 25-55 years old.

-

Your business should have a vintage of at least 3 years.

-

Your business should have its Income Tax returns filed for at least the past 1 year.

You may need to submit other relevant financial documents at the time of document verification. You will be informed of these as and when required.

Here is a list of the Business Loan customer profiles that we consider:

- Self Employed Professionals (SEP)

- Allopathic doctors, chartered accountants, company secretaries and architects who are practicing their profession. Proof of qualification – document to be shared

- Self Employed Non Professionals (SENP)

- Traders and manufacturers, retailers, Proprietors, and service providers etc

- Entities

- Partnerships, Limited Liability Partnership, Private Limited and closely held Limited companies. Other constitution types depending on their profile on a case to case basis