What is Machinery Loan?

A machinery loan allows you to finance the purchase of machinery and equipment essential for smooth operations of your business. It helps in funding the lease or purchase of new machinery, as well as the repair of existing machinery that may have broken down.

Machinery loans are suitable for micro, small and medium scale manufacturing units, which are in need of urgent capital to buy and upgrade equipment and also for increasing overall productivity. The loan offers much-needed support to any manufacturing business.

For instance, if you have a printing business and you had to purchase printing machinery with the latest technology and expand your business, but don’t have the necessary funds to buy the expensive machinery. You can approach the financial institution for machinery loan and can purchase the machinery for fuelling your business requirements.

Machinery loan can be used to support new equipment purchase and financing or for maintenance and repair of existing equipment thereby increasing the overall productivity for the business.

When Should I Take Unsecured Business Loans ?

| Business Loan Interest Rate | Competitive interest rate starting at 10.15% or Plus |

| Loan Amount | Minimum 1 Lakhs Maximum 100% |

| Nature of Business Loan | Unsecured (No mortgage required) |

| Loan Tenure | Ranges from 36 months to 60 months |

| Processing Fee | Up to 2% of loan amount |

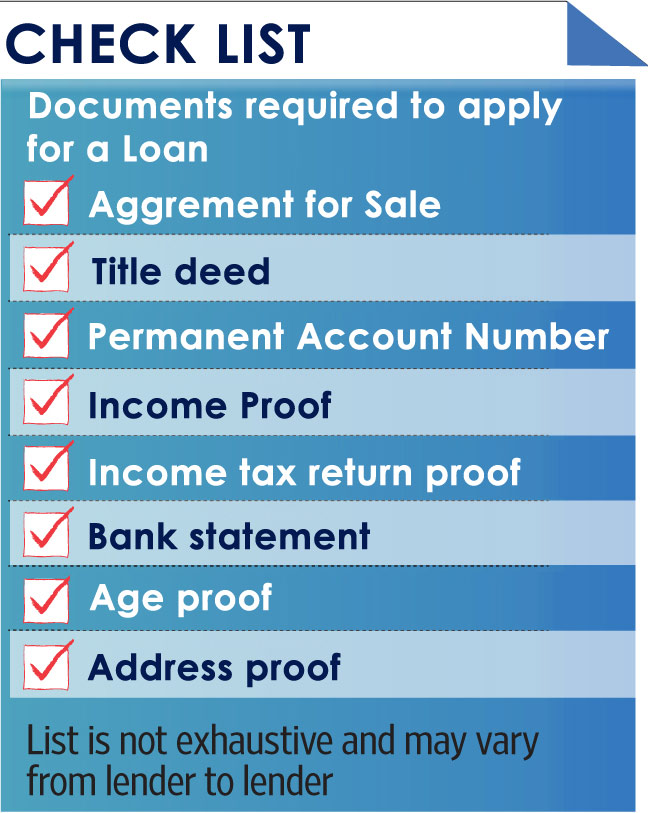

Documents Required

Every customer has to satisfy the Know Your Customer (KYC) norms stipulated by RBI. You have to provide the documents relating to your KYC, employment, business, and income.

Identity Proof

- PAN Card

- Aadhar Card

- Voter ID

- Driving Licence

- Passport

Address Proof

- Registered Rent agreement

- Aadhar Card

- Driving License

- Lease agreement

- Passport

- Latest Gas or electricity bill

Financial Documents – Employment or Business Proof

- Salary slips for the last 6 months in case you are a salaried employee (In addition, you can provide IT returns for the past 3 years along with Form 16)

- IT returns for the past 3 years in case you are self-employed (Some banks accept 2 years IT returns as well)

- Statement of A/c for the past 1 year where your salary is credited (in case of salaried people)

- Profit and Loss statement and Balance sheet for the last 2 years in case of self-employed persons

- Sales tax, GST registration certificates, if applicable

- Partnership deed in case of partnership firms (if the applicant is one of the partners)

- Certificate of Incorporation in case of limited companies(if the applicant is one of the directors)

Other documents:

- Loan application form duly filled in

- Photographs

- Signature Proof

The interest rate to be charged on a machinery loan varies from case to case depending on the facilities offered, the financial position of the borrower, etc. Exact details can be provided by your relationship officers. Here is a list of the processing fees and charges.

Qualifying for a business loan from BANK is simple. You just need to fulfill the following criteria to avail the benefits of the loan:

-

You should be between 25-55 years old.

-

Your business should have a vintage of at least 3 years.

-

Your business should have its Income Tax returns filed for at least the past 1 year.

You may need to submit other relevant financial documents at the time of document verification. You will be informed of these as and when required.

Here is a list of the Business Loan customer profiles that we consider:

- Self Employed Professionals (SEP)

- Allopathic doctors, chartered accountants, company secretaries and architects who are practicing their profession. Proof of qualification – document to be shared

- Self Employed Non Professionals (SENP)

- Traders and manufacturers, retailers, Proprietors, and service providers etc

- Entities

- Partnerships, Limited Liability Partnership, Private Limited and closely held Limited companies. Other constitution types depending on their profile on a case to case basis

Frequently asked questions (FAQ)

You can avail a maximum funding up to 100% of your equipment value.

Loan tenure varies from 3 months to 5 years.

You can use our business loan EMI calculator to calculate the EMI you need to pay based on your convenience.

Secured business loans are a common funding instrument for small businesses. A secured business loan is any type of business funding instrument secured by a personal guarantee or by pledging valuable assets as collateral.

In simpler terms, you are assuring the lender of paying back the amount you borrow. And if you are unable to repay the sum, the lender is free to utilize the pledged asset or personal guarantee to recover their losses. Secured business loans offer affordable interest rates and longer term duration.

All types of small businesses could benefit greatly from this type of loan, however, companies that have mutual funds, vehicles, inventory, equipment, accounts receivable, land, buildings or other property to put up as collateral will have significantly lower payments and significantly longer repayment periods as compared to unsecured, collateral-free loans

Qualifying for a business loan from BANK is simple. You just need to fulfill the following criteria to avail the benefits of the loan:

-

You should be between 25-55 years old.

-

Your business should have a vintage of at least 3 years.

-

Your business should have its Income Tax returns filed for at least the past 1 year.

You may need to submit other relevant financial documents at the time of document verification. You will be informed of these as and when required.

Here is a list of the Business Loan customer profiles that we consider:

- Self Employed Professionals (SEP)

- Allopathic doctors, chartered accountants, company secretaries and architects who are practicing their profession. Proof of qualification – document to be shared

- Self Employed Non Professionals (SENP)

- Traders and manufacturers, retailers, Proprietors, and service providers etc

- Entities

- Partnerships, Limited Liability Partnership, Private Limited and closely held Limited companies. Other constitution types depending on their profile on a case to case basis